In markets driven by credit-based transactions, accounts receivable play a dual role — they enable growth through flexible credit terms but also burden enterprises with cash flow constraints and credit risk. For small and medium-sized enterprises (SMEs), this trade-off can be particularly challenging.

To address this issue, Hyperchain Technology, in collaboration with China Zheshang Bank (CZBank), launched the industry’s first blockchain-powered receivables management platform — a groundbreaking initiative designed to reshape the way enterprises handle receivables, financing, and credit circulation.

At the core of the platform is the concept of the “Blockchain Receivable Note” — a digital certificate issued on-chain that transforms traditional physical or electronic accounts receivable into programmable, traceable digital assets.

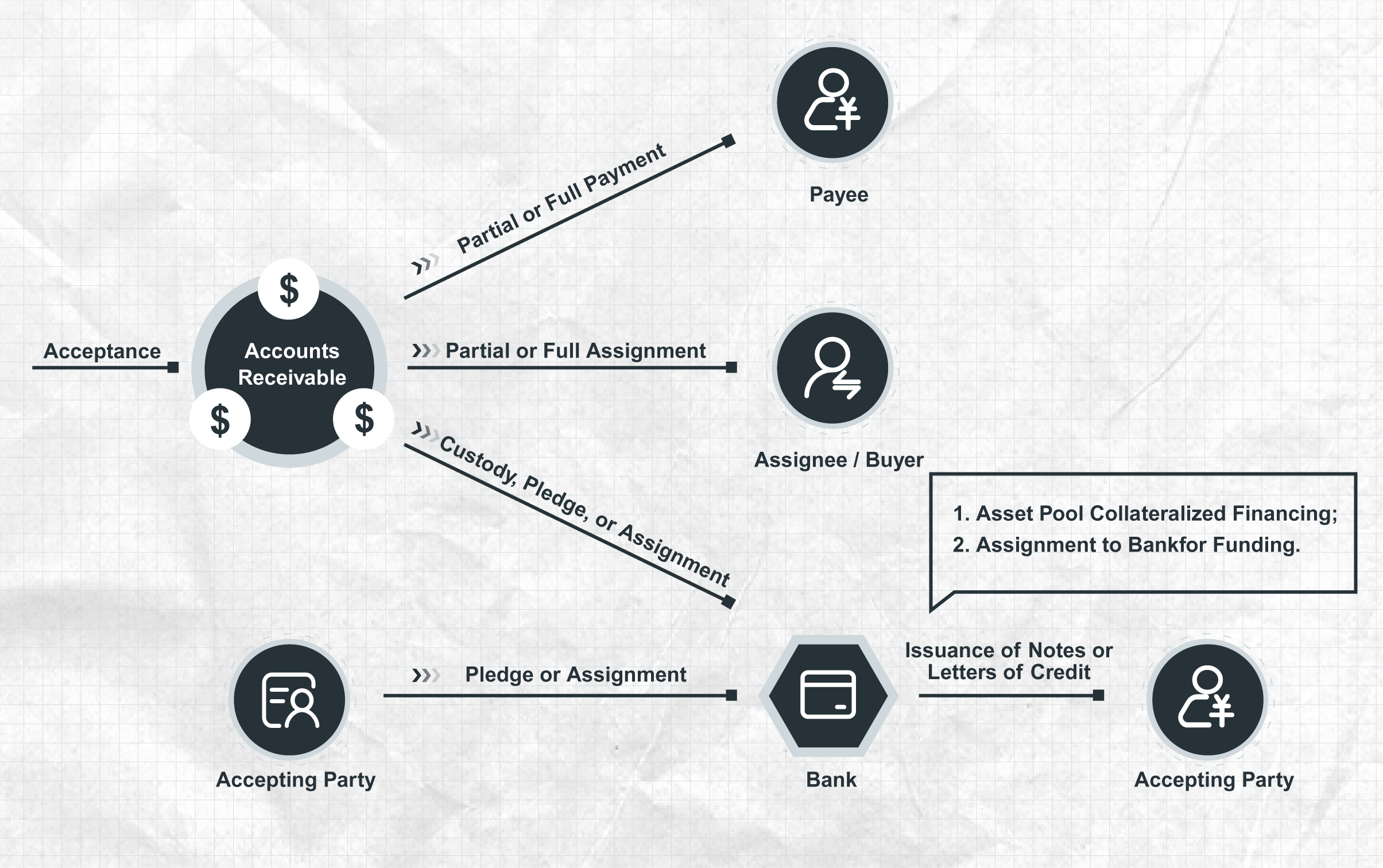

Each note includes critical transaction information such as payor/payee identity, amount, due date, and interest terms. These assets can be endorsed, transferred, pledged, and settled directly on-chain, streamlining the entire receivables lifecycle and turning them into both a digital payment instrument and a flexible financing tool.

How It Works

Enterprise-Centric Networks:

- Large enterprises can create private supplier ecosystems on the platform — similar to building closed business groups — inviting trusted upstream suppliers to join. Payments for goods or services are issued via blockchain receivable notes, ensuring traceability and reducing manual reconciliation.

Flexible Liquidity Options for Suppliers:

- Once in possession of a receivable note, suppliers can:

- Use it to pay other members within the network;

- Transfer it to banks or financial institutions for financing;

- Pool these assets for collateral-based lending — without losing ownership.

This model creates a fluid, secure, and credit-preserving financing environment, especially beneficial for SMEs that often face difficulties in accessing traditional credit channels.

Why Blockchain Matters

While the overall model resembles traditional supply chain finance, blockchain technology adds key advantages:

Data Trustworthiness & Transparency:

- Each transaction step — from issuance to transfer and settlement — is immutable and verifiable on-chain, significantly reducing fraud and reconciliation costs.

Multi-tier Supply Chain Enablement:

- Blockchain makes it possible to extend credit visibility beyond direct suppliers. Even lower-tier vendors who haven’t interacted directly with anchor enterprises can benefit from upstream credit endorsement.

Efficient, Digital Financing:

- Receivables can be split, transferred, and discounted digitally — overcoming the traditional limitations of paper-based instruments and enabling faster cash flow cycles for SMEs.

Guided by the principle of “technology for good,” Hyperchain’s blockchain receivables platform has delivered significant real-world impact:

- Industries Served: Automotive, industrial electronics, steel, ICT, and more — over 30 sectors

- Core Enterprises Engaged: Thousands of large anchor companies

- Financing Enabled: Over RMB 220 billion (~USD 31 billion) in cumulative financing

- Receivables Activated: Over RMB 550 billion (~USD 78 billion)

- SMEs Supported: More than 30,000 upstream and downstream enterprises

This initiative has not only unlocked working capital for businesses but also accelerated transaction cycles and improved resource allocation efficiency across China’s industrial landscape — offering a scalable blueprint for digital finance ecosystems globally.

Follow us on X & LinkedIn! @Hyperchain Technology